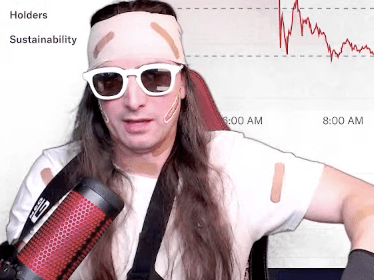

Will Roaring Kitty Profit from GME options?

$3,380 交易量

$3,380 交易量

Jun 21, 2024

规则

This market will resolve to "Yes" if Keith Gill, known as "Roaring Kitty" sells or exercises his 120,000 GameStop June 21, 2024 call options at a profit before market close on June 21, 2024.

If all call options are sold at a cumulative loss or otherwise expire worthless, this market will resolve to "No."

If it is still unknown by June 28, 2024, 12:00 PM ET whether Keith Gill’s call options were sold for a profit or not, this market will resolve based on GME’s close price on June 21 - if it closed above $25.68 (the strike price of $20 plus the purchase cost of $5.6754 per contract, rounded to the nearest cent), the market resolves to “Yes”, otherwise it resolves to “No.”

This market refers only to the original 120,000 options purchased and announced by Gill. Any new purchases will not be considered.

The resolution source is a consensus of credible reporting or information from Keith Gill.

If all call options are sold at a cumulative loss or otherwise expire worthless, this market will resolve to "No."

If it is still unknown by June 28, 2024, 12:00 PM ET whether Keith Gill’s call options were sold for a profit or not, this market will resolve based on GME’s close price on June 21 - if it closed above $25.68 (the strike price of $20 plus the purchase cost of $5.6754 per contract, rounded to the nearest cent), the market resolves to “Yes”, otherwise it resolves to “No.”

This market refers only to the original 120,000 options purchased and announced by Gill. Any new purchases will not be considered.

The resolution source is a consensus of credible reporting or information from Keith Gill.

创建于: Jun 11, 2024, 6:31 PM ET

交易量

$3,380结束日期

Jun 21, 2024创建于

Jun 11, 2024, 6:31 PM ETResolver

0x6A9D22261...已提议结果: Yes

无争议

最终结果: Yes

Will Roaring Kitty Profit from GME options?

$3,380 交易量

$3,380 交易量

Jun 21, 2024

关于

This market will resolve to "Yes" if Keith Gill, known as "Roaring Kitty" sells or exercises his 120,000 GameStop June 21, 2024 call options at a profit before market close on June 21, 2024.

If all call options are sold at a cumulative loss or otherwise expire worthless, this market will resolve to "No."

If it is still unknown by June 28, 2024, 12:00 PM ET whether Keith Gill’s call options were sold for a profit or not, this market will resolve based on GME’s close price on June 21 - if it closed above $25.68 (the strike price of $20 plus the purchase cost of $5.6754 per contract, rounded to the nearest cent), the market resolves to “Yes”, otherwise it resolves to “No.”

This market refers only to the original 120,000 options purchased and announced by Gill. Any new purchases will not be considered.

The resolution source is a consensus of credible reporting or information from Keith Gill.

If all call options are sold at a cumulative loss or otherwise expire worthless, this market will resolve to "No."

If it is still unknown by June 28, 2024, 12:00 PM ET whether Keith Gill’s call options were sold for a profit or not, this market will resolve based on GME’s close price on June 21 - if it closed above $25.68 (the strike price of $20 plus the purchase cost of $5.6754 per contract, rounded to the nearest cent), the market resolves to “Yes”, otherwise it resolves to “No.”

This market refers only to the original 120,000 options purchased and announced by Gill. Any new purchases will not be considered.

The resolution source is a consensus of credible reporting or information from Keith Gill.

交易量

$3,380结束日期

Jun 21, 2024创建于

Jun 11, 2024, 6:31 PM ETResolver

0x6A9D22261...已提议结果: Yes

无争议

最终结果: Yes

注意外部链接。

注意外部链接。

注意外部链接。

注意外部链接。